In the ever-fluctuating world of cryptocurrencies, timing is everything. Is now the moment to dive in and purchase a mining rig? This question echoes through the digital halls of Bitcoin enthusiasts and Ethereum aficionados alike, as prices swing like a pendulum driven by market whims and technological advancements. With companies specializing in selling and hosting mining machines, understanding current trajectories can mean the difference between profit and peril. Let’s unpack this intricate dance of supply, demand, and innovation.

The cryptocurrency landscape has evolved dramatically since Bitcoin’s inception, with mining rigs at the heart of the operation. These powerful machines, often referred to as miners, crunch complex algorithms to validate transactions and mint new coins. Today, as Bitcoin hovers around its all-time highs, the cost of entry into this arena is a hot topic. Prices for top-tier mining rigs have surged, influenced by factors like semiconductor shortages and escalating energy demands. Yet, for those eyeing long-term gains, the dip in second-hand markets might present an opportunistic buy.

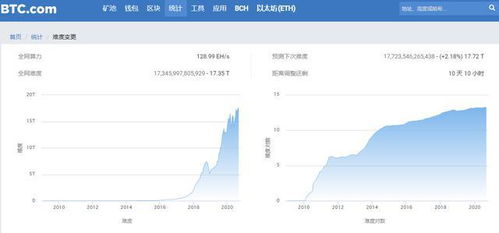

Consider Bitcoin (BTC), the flagship currency that set the stage for mining’s popularity. Its price trajectory often dictates the broader market’s mood, with recent halvings reducing rewards and pushing miners to seek efficiency. If BTC’s value climbs, so does the appeal of investing in robust mining setups. Picture the hum of ASIC miners in vast data centers, where hosting services allow individuals to participate without the hassle of setup. This is where companies shine, offering secure, energy-efficient hosting that could turn a modest investment into a steady income stream.

Shifting gears to Ethereum (ETH), the smart contract pioneer, we see a different narrative. With the transition to Proof-of-Stake, ETH mining might fade, yet the ecosystem’s growth fuels interest in versatile rigs that could adapt to other chains. Prices for multi-coin miners have become unpredictable, dipping when network difficulties rise or soaring amid bullish forecasts. This burst of variability keeps investors on their toes, wondering if today’s dip signals tomorrow’s boom.

Dogecoin (DOG), the meme-fueled underdog, adds another layer of whimsy to the mix. Though less resource-intensive than BTC or ETH, its surges can spike demand for entry-level rigs, making mining accessible to newcomers. Imagine a world where a casual hobbyist hosts a simple rig in a professional mining farm, reaping rewards from viral trends. These farms, sprawling operations optimized for cooling and electricity, underscore the importance of strategic hosting partnerships.

Mining farms represent the industrial side of this digital gold rush. They house rows of miners, each whirring away in climate-controlled environments, far from the average user’s garage. Prices for hosting services have stabilized recently, offering a cost-effective alternative to outright purchases. But as energy costs climb and regulations tighten, the trajectory could shift, urging buyers to act before external pressures inflate expenses.

The concept of a mining rig itself is fascinating—a symphony of hardware components working in unison. From GPUs in ETH’s heyday to specialized ASICs for BTC, these rigs evolve with technology. Current prices reflect this innovation, with premium models fetching thousands amid supply constraints. Yet, the market’s burstiness means a sudden drop could occur, perhaps triggered by a major exchange hack or a regulatory announcement, creating buying opportunities for the savvy.

In wrapping up this analysis, the decision to buy a mining rig hinges on personal strategy and market foresight. For BTC loyalists, the upward trajectory suggests potential rewards, while ETH’s shift might favor diversified investments. DOG’s unpredictability adds a sprinkle of excitement, reminding us that mining isn’t just about rigs—it’s about the ecosystem. If you’re considering a purchase, explore hosting options to mitigate risks and maximize returns. After all, in the crypto world, timing isn’t just key; it’s the entire lock.

Leave a Reply